ChartTrader – Bull Market Recap, Seasonal Patterns, RSI Ranges, Symbols: IGV, SMH, XLE, XES, NVDA, LMT, NOC, LLY (Premium)

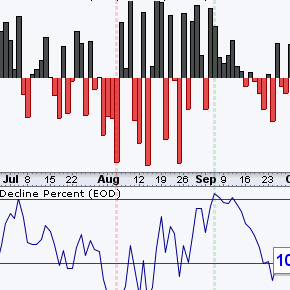

Let’s first recap the broad market environment. The most recent bull run started with an S&P 1500 Zweig Breadth Thrust on November 3rd. This initial surge extended throughout November